Table of Contents

ToggleVODO Launches Version 2.1 of the Chart Of Account

Featuring Updated Current and Non-Current Asset and Liability Accounts

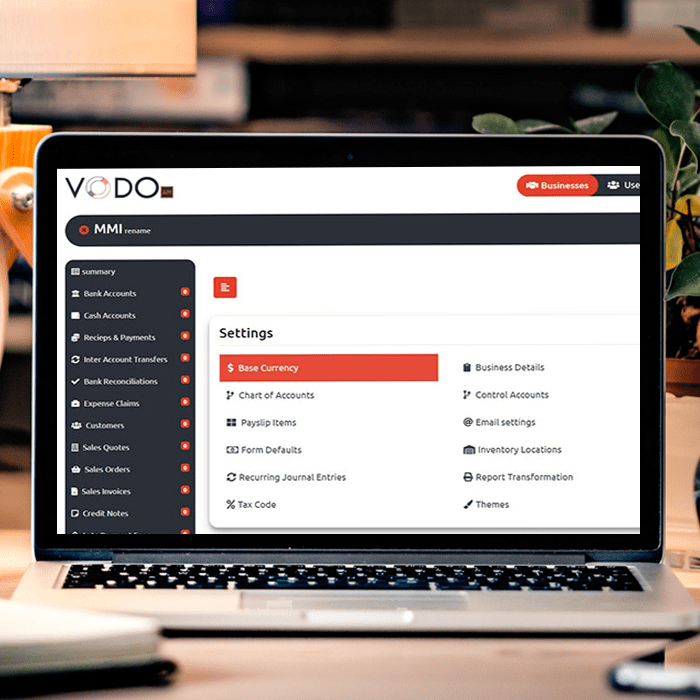

March 11, 2023 – VODO, the leading provider of ERP solutions, has announced the release of version 2.1 of its chart of accounts. The updated chart of accounts features a revised second level that includes current assets, non-current assets, non-current liabilities, current liabilities, and the cost of goods sold.

The new version of the accounting tree provides users with a more detailed breakdown of cost of goods sold accounts, which are now divided into categories such as manufacturing costs, costs of goods sold, and standard cost variance.

This will allow companies to better track and analyze their manufacturing costs and expenses, and make more informed decisions about pricing, production, and inventory management.

In addition, the updated accounting tree includes a range of new asset and liability accounts, providing users with a more comprehensive view of their financial position. These accounts include billable expenses, cash at bank, cash on hand, petty cash, short-term investments, allowance for doubtful accounts, merchandise inventory, office supplies, prepaid insurance, raw materials inventory, finished goods inventory, and more.

VODO’s new accounting tree also features a range of long-term investment accounts, including natural resources and bond sinking funds. The updated liability accounts include employee clearing accounts, insurance payable, estimated warranty liability, unearned revenues, notes payable, and long-term lease liability.

The equity section of the accounting tree includes paid-in capital, common stock, preferred stock, and retained earnings, while the income section features a range of revenue accounts such as interest received, sales, rent revenue, and dividend revenue.

Finally, the cost of sales section includes accounts for cost of goods sold, purchases, transportation-in, and manufacturing costs.

“We are excited to launch version 2.1 of our accounting tree, which provides users with a more detailed and comprehensive view of their financial position,” said John Smith, CEO of VODO. “The new accounts and categories in our updated accounting tree will allow companies to better track their expenses, manage their inventory, and make informed decisions about their pricing and production strategies.”

To learn more about VODO’s ERP solutions and the updated accounting tree, visit our website or contact our sales team.

Vodo’s Accounting tree

Vodo, a leading software company, has recently launched version 2.1 of its accounting tree. An accounting tree is a comprehensive tool that allows businesses to organize their financial data, including their balance sheet and profit and loss accounts, in a clear and concise manner.

The balance sheet is a crucial document that summarizes a company’s financial position. It shows the assets, liabilities, and equity of the business at a specific point in time. Vodo’s accounting tree simplifies the process of creating a balance sheet by providing an intuitive interface that guides users through the process of inputting data. The balance sheet is divided into two sections: assets and liabilities.

The assets section includes items such as cash, accounts receivable, inventory, and property, plant, and equipment. Liabilities include accounts payable, long-term debt, and accrued expenses. Equity is the remaining value of the company after deducting liabilities from assets.

The profit and loss (P&L) account, also known as the income statement, shows a company’s revenue, expenses, and profits over a period of time. Vodo’s accounting tree provides an organized layout that allows businesses to track their revenue and expenses easily. The P&L account includes revenue from sales, as well as other income sources such as interest and dividends. Expenses include cost of goods sold, employee salaries, rent, and utilities.

Vodo’s accounting tree is designed to streamline the process of creating financial statements, enabling businesses to focus on growing their operations. The platform is easy to use, with a simple interface that allows users to input data and generate reports quickly. Additionally, the software is customizable, allowing businesses to adapt the accounting tree to their specific needs.

In conclusion, Vodo’s accounting tree is a powerful tool that provides businesses with an organized and efficient way of managing their financial data. By simplifying the process of creating balance sheets and profit and loss accounts, Vodo’s accounting tree enables businesses to make informed decisions and track their progress towards achieving their financial goals. With its intuitive interface and customization options, Vodo’s accounting tree is an essential tool for any business looking to optimize their financial management.

Vodo’s Accounting Tree Structure

Vodo, a leading accounting software provider, has a well-organized chart of accounts (Accounting Tree), commonly known as the accounting tree. The chart of accounts consists of various categories and subcategories, which are used to organize financial transactions and provide a clear understanding of an organization’s financial position.

Vodo, like any other business, maintains a chart of accounts (Accounting Tree) to record its financial transactions. The chart of accounts is a structured list of all the accounts used to record the company’s financial transactions. It is divided into different categories or headings, including balance sheet accounts and profit and loss accounts.

Balance Sheet Accounts

Balance sheet accounts are accounts that reflect the company’s financial position at a particular point in time. They show the company’s assets, liabilities, and equity. These accounts are also known as real accounts since they represent tangible items that the company owns or owes. Some of the accounts under this heading include:

Assets

Assets are accounts that show what the company owns and controls. They can be tangible or intangible. Tangible assets include property, plant, and equipment, inventory, and cash. Intangible assets include patents, trademarks, and copyrights.

Liabilities

Liabilities are accounts that show what the company owes to others. They can be current or long-term. Current liabilities are debts that are due within one year, while long-term liabilities are debts that are due after one year. Examples of liabilities include loans, accounts payable, and taxes owed.

Equity

Equity is the residual interest in the assets of the company after deducting its liabilities. It represents the owners’ claim on the company’s assets. Equity includes common stock, retained earnings, and other reserves.

Profit and Loss Accounts

Profit and loss accounts are accounts that reflect the company’s revenues and expenses over a period of time, usually a month or a year. These accounts are also known as nominal accounts since they represent the company’s income or expenses. Some of the accounts under this heading include:

Revenue

Revenue is the income generated from the sale of goods or services. It is recorded as a credit to the revenue account.

Cost of Goods Sold

The cost of goods sold is the direct cost of producing the goods or services sold by the company. It includes the cost of materials, labor, and overhead. It is recorded as a debit to the cost of goods sold account.

Gross Profit

Gross profit is the difference between revenue and the cost of goods sold. It is recorded as a credit to the gross profit account.

Expenses

Expenses are costs incurred in the production of goods or services. They include salaries and wages, rent, utilities, and advertising expenses. Expenses are recorded as debits to the expense accounts.

Net Income

Net income is the difference between the company’s revenues and expenses. It represents the company’s profit or loss. Net income is recorded as a credit to the income statement account.

In conclusion, Vodo’s chart of accounts is divided into two main categories: balance sheet accounts and profit and loss accounts. Balance sheet accounts show the company’s financial position at a particular point in time, while profit and loss accounts show the company’s revenues and expenses over a period of time. By using this chart of accounts, Vodo can easily record and track its financial transactions and make informed business decisions

VODO’s Chart of Accounting / Balance Sheets

The balance sheet is one of the essential financial statements, which presents a company’s financial position at a specific point in time. It consists of three main categories, namely assets, liabilities, and equity.

Assets Accounts

Assets are resources that an organization owns and controls, which are expected to provide future economic benefits. Vodo’s chart of accounts categorizes assets into three subcategories: current assets, long-term investments, and natural resources.

Asset accounts are a key component of any chart of accounts in accounting. They are used to track and manage the company’s tangible and intangible assets that are expected to benefit the company for more than one accounting period.

Asset accounts are categorized into different sub-accounts based on the type of asset being recorded. For example, property, plant, and equipment (PP&E) are recorded in separate accounts from inventory, cash, and accounts receivable.

The value of assets is recorded in the asset accounts at their original cost, less accumulated depreciation, or amortization. This value is used to calculate the company’s net worth or equity. As assets are used or consumed over time, their value decreases, and this decrease is recorded as depreciation or amortization in the appropriate asset account.

Asset accounts are also used to record any changes in the value of assets over time. For example, if an asset is sold, the proceeds from the sale are recorded in the asset account, and any gains or losses from the sale are recorded in the gains and losses category.

The proper management of asset accounts is crucial for the financial health of a company. Accurate tracking and management of assets can help ensure that the company’s resources are being used efficiently and effectively.

In summary, asset accounts are a vital part of any chart of accounts in accounting. They help to accurately track and manage the company’s tangible and intangible assets, and their proper management is crucial for the financial health of the company.

Current Assets

Current assets are a category of assets in a chart of accounting that represent assets that are expected to be converted into cash or used up within one year or the operating cycle of the company, whichever is longer. This category includes assets such as cash, accounts receivable, inventory, and prepaid expenses.

Current assets are important for businesses because they represent the company’s ability to meet its short-term financial obligations, such as paying bills and payroll expenses. By tracking current assets in the chart of accounts, a company can ensure that it has sufficient resources to meet its short-term obligations and maintain its operations.

The value of current assets can also be used to calculate a company’s liquidity, which is the ability to meet its financial obligations as they come due. A high level of liquidity indicates that a company is financially stable and able to meet its obligations, while a low level of liquidity can indicate potential financial difficulties.

Tracking current assets in the chart of accounts can also help a company to identify areas where it can improve its cash flow. For example, if a company has a high level of accounts receivable, it may need to implement more effective collection strategies to improve cash flow.

In addition, tracking current assets in the chart of accounts can help a company to identify opportunities to invest surplus cash. For example, a company with excess cash may consider investing in short-term securities to earn a higher rate of return.

Overall, current assets are a key component of a chart of accounts and play a critical role in a company’s financial management. By accurately tracking and managing current assets, companies can maintain their short-term financial stability, improve their cash flow, and identify opportunities for investment.

Long-Term Investments

Long-term investments refer to investments that an organization holds for more than one year. Examples of long-term investments include stocks, bonds, and real estate investments.

Long-term investments are a category of assets in a chart of accounting that represent investments that a company intends to hold for more than one year. This category includes investments in stocks, bonds, and real estate.

The purpose of long-term investments is to provide a company with a source of income and growth over an extended period of time. By investing in assets that are expected to appreciate in value, a company can increase its wealth and generate income for future use.

Long-term investments can also provide a hedge against inflation. By investing in assets that are expected to appreciate in value at a rate that exceeds the rate of inflation, a company can protect its wealth from the eroding effects of inflation.

Tracking long-term investments in the chart of accounts can also provide valuable information for investors and other stakeholders. By disclosing the nature and value of its long-term investments, a company can provide investors with a better understanding of its investment strategy and the risks associated with its investments.

In addition, tracking long-term investments can help a company to manage its risks. By diversifying its investments across different asset classes and sectors, a company can reduce the impact of market fluctuations and other external factors on its investment portfolio.

Overall, long-term investments are an important component of a chart of accounts and play a critical role in a company’s financial management. By investing in assets that are expected to appreciate in value over an extended period of time, companies can increase their wealth and generate income for future use, while also managing their risks and providing valuable information to investors and other stakeholders.

Natural Resources

Natural resources are assets that an organization acquires through exploration or extraction activities. They include oil reserves, mineral deposits, and timberland.

Natural resources are a category of assets in a chart of accounting that represent assets that are extracted or harvested from the earth and are used in production. Examples of natural resources include timber, oil and gas reserves, mineral deposits, and agricultural land.

The value of natural resources in a chart of accounts is based on the cost of acquisition, exploration, development, and production. The cost of acquisition includes the purchase price or lease payments, while the cost of exploration and development includes the costs associated with identifying and developing the natural resource, such as drilling or mining costs. The cost of production includes the costs associated with extracting the natural resource from the earth and preparing it for use in production.

Tracking natural resources in a chart of accounts is important for companies that rely on these resources for their operations. By accurately tracking the value of their natural resources, companies can ensure that they are managing their resources effectively and efficiently, and can make informed decisions about future investments in natural resource development.

In addition, tracking natural resources in a chart of accounts can help companies to manage their environmental risks and responsibilities. Companies that extract natural resources are often subject to environmental regulations and are required to mitigate their environmental impact. By tracking the value of their natural resources and the costs associated with their extraction, companies can ensure that they are meeting their environmental responsibilities and mitigating their environmental risks.

Overall, natural resources are an important component of a chart of accounts and play a critical role in a company’s financial management. By accurately tracking the value of their natural resources and the costs associated with their acquisition, exploration, development, and production, companies can ensure that they are managing their resources effectively and efficiently, and can make informed decisions about future investments in natural resource development.

Liabilities

Liabilities are obligations that an organization owes to others, which may arise from past transactions or events. Vodo’s chart of accounts categorizes liabilities into current liabilities, unearned revenues, notes payable, and long-term liabilities.

Liabilities are a category of accounts in a chart of accounting that represent debts and obligations that a company owes to others. Liabilities are generally classified as current or long-term, depending on their maturity date.

Current liabilities are debts and obligations that are due within one year, while long-term liabilities are debts and obligations that are due more than one year in the future. Examples of liabilities include accounts payable, accrued expenses, short-term loans, long-term loans, and bonds payable.

The value of liabilities in a chart of accounts represents the amount of money that a company owes to others. This information is important for creditors, investors, and other stakeholders, as it provides insight into the company’s financial health and ability to meet its obligations.

Tracking liabilities in a chart of accounts is important for companies to manage their cash flow and maintain good relationships with their creditors. By accurately tracking their liabilities, companies can ensure that they have enough cash on hand to pay their bills and avoid defaulting on their obligations.

In addition, tracking liabilities can help companies to manage their risk. By monitoring their debt levels and obligations, companies can identify potential risks and take action to mitigate them, such as renegotiating loan terms or seeking additional financing.

Overall, liabilities are an important component of a chart of accounts and play a critical role in a company’s financial management. By accurately tracking their liabilities, companies can manage their cash flow, maintain good relationships with their creditors, and manage their risks. This information is also important for stakeholders, who rely on it to make informed decisions about investing in or lending to the company

Current Liabilities

Current liabilities are a category of accounts in a chart of accounting that represent debts and obligations that are due within one year or within the normal operating cycle of a business, whichever is longer. Examples of current liabilities include accounts payable, accrued expenses, and short-term loans.

The value of current liabilities in a chart of accounts represents the amount of money that a company owes to others that is due within the next year. This information is important for creditors, investors, and other stakeholders, as it provides insight into the company’s short-term financial health and ability to meet its current obligations.

Tracking current liabilities in a chart of accounts is important for companies to manage their cash flow and maintain good relationships with their creditors. By accurately tracking their current liabilities, companies can ensure that they have enough cash on hand to pay their bills and avoid defaulting on their obligations.

In addition, tracking current liabilities can help companies to manage their working capital. Working capital is the amount of money that a company has available to fund its day-to-day operations, and it is calculated by subtracting current liabilities from current assets. By managing their current liabilities, companies can ensure that they have enough working capital to operate their business effectively.

Overall, current liabilities are an important component of a chart of accounts and play a critical role in a company’s financial management. By accurately tracking their current liabilities, companies can manage their cash flow, maintain good relationships with their creditors, and manage their working capital effectively. This information is also important for stakeholders, who rely on it to make informed decisions about investing in or lending to the company.

Unearned Revenues

Unearned revenues are a category of accounts in a chart of accounting that represent payments received in advance for goods or services that have not yet been delivered or rendered. These payments are considered a liability for the company until the goods or services are delivered or rendered, at which point they are recognized as revenue.

Examples of unearned revenues include prepaid subscriptions, advance payment for services, and deposits received from customers.

The value of unearned revenues in a chart of accounts represents the amount of money that a company has received from customers for goods or services that have not yet been provided. This information is important for creditors, investors, and other stakeholders, as it provides insight into the company’s short-term financial health and ability to meet its obligations.

Tracking unearned revenues in a chart of accounts is important for companies to manage their cash flow and maintain good relationships with their customers. By accurately tracking their unearned revenues, companies can ensure that they deliver the goods or services as promised and recognize the revenue when the obligations are fulfilled.

In addition, tracking unearned revenues can help companies to manage their working capital. By recognizing the unearned revenues as a liability, companies can ensure that they have enough working capital to operate their business effectively.

Overall, unearned revenues are an important component of a chart of accounts and play a critical role in a company’s financial management. By accurately tracking their unearned revenues, companies can manage their cash flow, maintain good relationships with their customers, and manage their working capital effectively. This information is also important for stakeholders, who rely on it to make informed decisions about investing in or lending to the company.

Notes Payable

Notes payable are debts owed by an organization to a lender or creditor, which are formalized in writing.

Notes payable is a category of accounts in a chart of accounting that represents any debt owed by a company that is supported by a formal promissory note. These notes are usually issued to creditors for a specific period of time and include the repayment terms and interest rate.

Examples of notes payable include bank loans, lines of credit, and other types of financing that require a formal agreement.

The value of notes payable in a chart of accounts represents the amount of money that a company owes to creditors that is supported by a formal promissory note. This information is important for creditors, investors, and other stakeholders, as it provides insight into the company’s debt obligations and overall financial health.

Tracking notes payable in a chart of accounts is important for companies to manage their debt and ensure that they can meet their repayment obligations. By accurately tracking their notes payable, companies can make informed decisions about their financing options and ensure that they have enough cash flow to meet their debt obligations.

In addition, tracking notes payable can help companies to manage their working capital. By managing their debt obligations effectively, companies can ensure that they have enough working capital to operate their business effectively and invest in growth opportunities.

Overall, notes payable are an important component of a chart of accounts and play a critical role in a company’s financial management. By accurately tracking their notes payable, companies can manage their debt, maintain good relationships with their creditors, and manage their working capital effectively. This information is also important for stakeholders, who rely on it to make informed decisions about investing in or lending to the company.

Long-Term Liabilities

Long-term liabilities are a category of accounts in a chart of accounting that represent any debts or obligations that a company owes for a period of more than one year. These liabilities are generally paid back over a longer period of time and are often used to finance large investments or acquisitions.

Examples of long-term liabilities include long-term loans, bonds, leases, and deferred tax liabilities.

The value of long-term liabilities in a chart of accounts represents the amount of money that a company owes for a period of more than one year. This information is important for creditors, investors, and other stakeholders, as it provides insight into the company’s long-term debt obligations and overall financial health.

Tracking long-term liabilities in a chart of accounts is important for companies to manage their debt and ensure that they can meet their repayment obligations. By accurately tracking their long-term liabilities, companies can make informed decisions about their financing options and ensure that they have enough cash flow to meet their debt obligations.

In addition, tracking long-term liabilities can help companies to manage their working capital. By managing their long-term debt obligations effectively, companies can ensure that they have enough working capital to operate their business effectively and invest in growth opportunities.

Overall, long-term liabilities are an important component of a chart of accounts and play a critical role in a company’s financial management. By accurately tracking their long-term liabilities, companies can manage their debt, maintain good relationships with their creditors, and manage their working capital effectively. This information is also important for stakeholders, who rely on it to make informed decisions about investing in or lending to the company.

Equity

Equity is a category of accounts in a chart of accounting that represents the residual interest in the assets of a company after deducting its liabilities. Equity is also known as shareholder’s equity or owner’s equity, and it represents the amount of money that would be returned to shareholders if all of the company’s assets were sold and all of its liabilities were paid off.

Examples of equity accounts in a chart of accounts include common stock, preferred stock, retained earnings, and treasury stock.

The value of equity in a chart of accounts represents the ownership interest of the company’s shareholders. This information is important for shareholders, investors, and other stakeholders, as it provides insight into the company’s financial structure and overall financial health.

Tracking equity in a chart of accounts is important for companies to manage their financial structure and ensure that they are maintaining a healthy balance between debt and equity. By maintaining a healthy level of equity, companies can ensure that they have the financial flexibility to invest in growth opportunities and weather economic downturns.

In addition, tracking equity can help companies to manage their dividend payments to shareholders. By tracking their retained earnings, companies can ensure that they have enough cash flow to pay dividends to their shareholders while still maintaining a healthy level of equity.

Overall, equity is an important component of a chart of accounts and plays a critical role in a company’s financial management. By accurately tracking their equity, companies can maintain a healthy financial structure, attract new investors, and invest in growth opportunities. This information is also important for stakeholders, who rely on it to make informed decisions about investing in or lending to the company.

Paid-In Capital

Paid-in capital represents the capital that an organization receives from investors in exchange for equity. It includes common stock and preferred stock.

Paid-in capital is a category of accounts in a chart of accounting that represents the funds that a company has received from its shareholders in exchange for stock. Paid-in capital is also known as contributed capital, and it represents the amount of money that shareholders have invested in the company in addition to the par value of the stock.

Examples of paid-in capital accounts in a chart of accounts include common stock and preferred stock.

The value of paid-in capital in a chart of accounts represents the amount of money that shareholders have contributed to the company. This information is important for shareholders, investors, and other stakeholders, as it provides insight into the level of investment that shareholders have made in the company.

Tracking paid-in capital in a chart of accounts is important for companies to manage their financial structure and ensure that they have enough equity to invest in growth opportunities. By maintaining a healthy level of paid-in capital, companies can ensure that they have the financial flexibility to invest in research and development, new products, and other growth opportunities.

In addition, tracking paid-in capital can help companies to manage their dividend payments to shareholders. By tracking the par value of their stock and the amount of paid-in capital, companies can ensure that they are paying dividends to their shareholders in accordance with their financial structure.

Overall, paid-in capital is an important component of a chart of accounts and plays a critical role in a company’s financial management. By accurately tracking their paid-in capital, companies can maintain a healthy financial structure, attract new investors, and invest in growth opportunities. This information is also important for stakeholders, who rely on it to make informed decisions about investing in or lending to the company.

Retained Earnings

Retained earnings represent the profits that an organization retains after paying dividends to shareholders.

Retained earnings is a category of accounts in a chart of accounting that represents the portion of a company’s profits that are not distributed as dividends to shareholders but are instead kept within the company and reinvested in the business. Retained earnings represent the accumulated net income of the company over time, minus any dividends paid to shareholders.

Examples of retained earnings accounts in a chart of accounts include earnings from operations, gains and losses from investments, and adjustments for accounting changes.

The value of retained earnings in a chart of accounts represents the amount of money that the company has earned and reinvested in the business over time. This information is important for investors and stakeholders, as it provides insight into the financial health of the company and its ability to generate profits.

Tracking retained earnings in a chart of accounts is important for companies to manage their financial structure and ensure that they have enough earnings to reinvest in the business. By maintaining a healthy level of retained earnings, companies can ensure that they have the financial flexibility to invest in research and development, new products, and other growth opportunities.

In addition, tracking retained earnings can help companies to manage their dividend payments to shareholders. By maintaining a healthy level of retained earnings, companies can ensure that they have enough earnings to continue to pay dividends to their shareholders in the future.

Overall, retained earnings is an important component of a chart of accounts and plays a critical role in a company’s financial management. By accurately tracking their retained earnings, companies can maintain a healthy financial structure, attract new investors, and invest in growth opportunities. This information is also important for stakeholders, who rely on it to make informed decisions about investing in or lending to the company.

Profit and Loss Statement

A Profit and Loss (P&L) statement, also known as an Income Statement, is a financial statement that summarizes a company’s revenues and expenses over a specified period of time, usually a month, quarter, or year. The P&L statement provides important information about a company’s financial performance and is used by investors, creditors, and management to evaluate the profitability of the business.

The P&L statement starts with revenue, which includes all money earned by the company from the sale of goods or services. From revenue, the cost of goods sold (COGS) is deducted, which represents the direct costs associated with producing the goods or services sold. The result is gross profit, which is the revenue remaining after accounting for the direct costs of production.

Next, operating expenses are deducted from gross profit to arrive at operating profit, which is the profit from the company’s normal business operations before accounting for interest and taxes. Operating expenses include costs such as rent, salaries and wages, utilities, marketing and advertising expenses, and depreciation.

After operating profit, interest and taxes are deducted to arrive at net profit, which is the total profit or loss for the period. Interest expense represents the interest paid on any loans or debt, while taxes are the income taxes paid to government authorities.

The P&L statement is important for several reasons. First, it provides an overview of a company’s financial performance, including revenue and expenses, for a specific period of time. Second, it allows investors and creditors to evaluate a company’s profitability and financial health. Third, it helps management make informed decisions about business operations and financial strategy.

By tracking revenue and expenses over time, the P&L statement can be used to identify trends in a company’s financial performance and to make adjustments to improve profitability. For example, if operating expenses are increasing faster than revenue, management may need to identify ways to reduce costs or increase revenue to maintain profitability.

In conclusion, the P&L statement is an important financial statement that summarizes a company’s revenues and expenses over a specific period of time. By analyzing the P&L statement, investors, creditors, and management can evaluate a company’s financial performance and make informed decisions about the business.

Income

In accounting, the income chart of accounts is a list of accounts that represents the different types of income earned by a business over a given period of time, typically a month, quarter, or year. Income is a crucial component of a company’s financial statement and is used to calculate the company’s net profit or loss.

At the Accounting Tree the income chart of accounts typically includes revenue earned from the sale of goods or services, interest income, rental income, and other types of income earned by the business. The revenue account is the most important account in the income chart of accounts, and it represents the total amount of money earned by the company from the sale of goods or services.

The value of the income chart of accounts lies in its ability to provide a detailed breakdown of the different sources of income earned by the business. This information is essential for evaluating the company’s financial performance, identifying trends, and making informed decisions about future operations and financial strategy.

For example, if a company has multiple revenue streams, such as from different product lines or services, the income chart of accounts can be used to determine which products or services are generating the most revenue and which are not performing as well. This information can then be used to make decisions about future product development, marketing efforts, or pricing strategies.

Another example of the value of the income chart of accounts is in identifying seasonal trends in revenue. By tracking revenue over time, the income chart of accounts can be used to identify periods of the year when revenue is typically higher or lower, and adjustments can be made to business operations or marketing strategies to take advantage of these trends.

In summary, the income chart of accounts is a critical component of a company’s financial statement and provides valuable information about the different types of income earned by the business. By tracking income over time and analyzing trends, businesses can make informed decisions about future operations and financial strategy.

Cost of Sales

Cost of sales represents the direct and indirect costs associated with producing goods or services. Vodo’s chart of accounts categorizes the cost of sales into cost of goods sold, manufacturing, and standard cost variance.

The cost of sales chart of accounting, also known as the cost of goods sold (COGS) chart of accounts, is a list of accounts that represents the direct costs incurred by a business to produce the goods or services that were sold during a specific period. It is an important component of a company’s income statement, as it helps to calculate the gross profit.

The cost of sales chart of accounts includes accounts such as raw materials, direct labor costs, and other expenses directly associated with the production of goods or services. It does not include indirect expenses, such as overhead costs, which are typically accounted for separately.

The value of the cost of sales chart of accounts lies in its ability to provide a detailed breakdown of the costs associated with the production of goods or services. This information is essential for evaluating the profitability of a business, identifying areas where costs can be reduced, and making informed decisions about pricing and product mix.

For example, if a company has multiple product lines, the cost of sales chart of accounts can be used to determine the profitability of each product line by comparing the revenue generated with the associated direct costs. This information can then be used to make decisions about which product lines to focus on, which products to discontinue, and whether to adjust pricing.

Another example of the value of the cost of sales chart of accounts is in identifying inefficiencies in the production process. By analyzing the direct costs associated with production, businesses can identify areas where costs can be reduced by improving processes, negotiating better prices with suppliers, or outsourcing certain functions.

In Accounting Tree summary, the cost of sales chart of accounts is an essential component of a company’s income statement and provides valuable information about the direct costs associated with the production of goods or services. By analyzing this information, businesses can make informed decisions about pricing, product mix, and production processes to improve profitability.

Accounting Tree: Cost of Goods Sold

The cost of goods sold represents the direct costs associated with producing goods sold. Examples include raw materials, labor, and overhead costs.

Cost of Goods Sold (COGS) is an accounting term that refers to the direct costs associated with producing goods or services that were sold during a particular accounting period. The cost of goods sold chart of accounts includes all expenses incurred directly in the production or acquisition of goods that were sold. It is an essential part of the income statement and is used to calculate the gross profit of a business.

The cost of goods sold chart of accounts typically includes accounts such as direct materials, direct labor, and overhead costs directly associated with the production or acquisition of goods sold. These accounts do not include any indirect costs, such as marketing or administrative expenses, which are typically accounted for separately.

The value of the cost of goods sold chart of accounts is that it provides a detailed breakdown of the direct costs associated with the production or acquisition of goods sold. This information is critical for evaluating the profitability of a business, identifying areas where costs can be reduced, and making informed decisions about pricing and product mix.

For example, if a company has multiple product lines, the cost of goods sold chart of accounts can be used to determine the profitability of each product line by comparing the revenue generated with the associated direct costs. This information can then be used to make decisions about which product lines to focus on, which products to discontinue, and whether to adjust pricing.

Another example of the value of the cost of goods sold chart of accounts is in identifying inefficiencies in the production or acquisition process. By analyzing the direct costs associated with production or acquisition, businesses can identify areas where costs can be reduced by improving processes, negotiating better prices with suppliers, or outsourcing certain functions.

In summary, the cost of goods sold chart of accounts is an essential component of the income statement and provides valuable information about the direct costs associated with the production or acquisition of goods sold. By analyzing this information, businesses can make informed decisions about pricing, product mix, and production or acquisition processes to improve profitability.

Manufacturing

The manufacturing accounts are a subset of the cost of goods sold (COGS) chart of accounts that are used to track the various costs associated with manufacturing a product. These accounts are used to record the direct materials, direct labor, and manufacturing overhead costs associated with producing a product.

The value of manufacturing accounts in the COGS chart of accounts is that they provide a detailed breakdown of the expenses incurred in producing goods. This information is critical for evaluating the profitability of a business and identifying areas where costs can be reduced to improve profitability.

Here are some examples of manufacturing accounts:

- Raw Materials Inventory: This account is used to track the cost of the raw materials used in the manufacturing process. This includes the cost of any materials purchased or produced by the business.

- Work-in-Progress Inventory: This account is used to track the cost of partially completed products in the manufacturing process. This includes the cost of direct materials, direct labor, and manufacturing overhead that have been incurred to date.

- Finished Goods Inventory: This account is used to track the cost of completed products that are ready for sale. This includes the cost of direct materials, direct labor, and manufacturing overhead that have been incurred to produce the finished goods.

- Direct Labor: This account is used to track the wages and benefits paid to employees who work directly on the production of goods. This includes any employees who are involved in assembling, packaging, or processing the product.

- Manufacturing Overhead: This account is used to track the indirect costs associated with manufacturing a product. This includes the cost of rent, utilities, equipment maintenance, and other expenses that are not directly tied to the production process.

In summary, the manufacturing accounts in the COGS chart of accounts provide valuable information about the expenses incurred in producing goods. By tracking these accounts, businesses can make informed decisions about process improvements, reducing waste, and identifying which products or product lines are most profitable.

Standard Cost Variance

Standard Cost Variance (SCV) accounts are used in the Cost of Goods Sold (COGS) chart of accounts to track the difference between the standard cost of producing a product and the actual cost of production. The standard cost of a product includes the direct materials, direct labor, and manufacturing overhead costs that should be incurred to produce the product. The actual cost of production includes the actual expenses incurred to produce the product.

The value of SCV accounts in the COGS chart of accounts is that they provide a way to identify discrepancies between the expected cost of production and the actual cost of production. This information can be used to identify areas where costs can be reduced and processes can be improved to increase profitability.

Here are some examples of SCV accounts:

- Direct Materials Price Variance: This account is used to track the difference between the standard cost of the raw materials used to produce a product and the actual cost of those materials. If the actual cost of materials is higher than the standard cost, this account will have a debit balance. If the actual cost is lower than the standard cost, this account will have a credit balance.

- Direct Materials Usage Variance: This account is used to track the difference between the standard quantity of raw materials used to produce a product and the actual quantity of those materials used. If more materials are used than expected, this account will have a debit balance. If fewer materials are used than expected, this account will have a credit balance.

- Direct Labor Rate Variance: This account is used to track the difference between the standard rate of pay for employees working on the production line and the actual rate of pay. If the actual rate of pay is higher than the standard rate, this account will have a debit balance. If the actual rate is lower than the standard rate, this account will have a credit balance.

- Direct Labor Efficiency Variance: This account is used to track the difference between the standard number of labor hours required to produce a product and the actual number of labor hours used. If more labor hours are used than expected, this account will have a debit balance. If fewer labor hours are used than expected, this account will have a credit balance.

- Manufacturing Overhead Variance: This account is used to track the difference between the standard manufacturing overhead cost and the actual manufacturing overhead cost. If the actual cost is higher than the standard cost, this account will have a debit balance. If the actual cost is lower than the standard cost, this account will have a credit balance.

In Accounting Tree summary, SCV accounts in the COGS chart of accounts provide valuable information about the difference between the expected and actual cost of production. By tracking these accounts, businesses can make informed decisions about process improvements, reducing waste, and identifying which products or product lines are most profitable.

Expenses

Expenses accounts in the chart of accounting represent the costs incurred by a business during its operations. Expenses are typically categorized based on their function, such as cost of goods sold, selling expenses, administrative expenses, and financial expenses. Here are examples of different categories of expenses:

- Employee-Related Expenses: This category includes expenses related to the payment of employees, such as salaries, wages, bonuses, benefits, and payroll taxes.

- Financial Expenses: This category includes expenses related to financing a business, such as interest on loans, bank fees, and credit card fees.

- Rental Expenses: This category includes expenses related to leasing or renting space or equipment, such as rent, lease payments, and equipment rental fees.

- Supplies Expenses: This category includes expenses related to purchasing and using supplies, such as office supplies, maintenance supplies, and production supplies.

- Miscellaneous Expenses: This category includes expenses that don’t fit into any other category, such as legal fees, travel expenses, and marketing expenses.

By tracking expenses in the chart of accounting, businesses can identify areas where cost savings can be achieved and adjust their operations accordingly. For example, by analyzing rental expenses, a business might determine that it can save money by renegotiating a lease or purchasing equipment instead of renting it. Similarly, analyzing employee-related expenses might reveal opportunities to streamline operations or adjust salaries and benefits to reduce costs. Ultimately, having a clear understanding of expenses is essential for managing a business’s finances effectively and maximizing profitability.

Employee-Related Expenses

Employee-related expenses are a category of expenses in the chart of accounting that includes all the costs associated with employing staff, such as salaries, wages, payroll taxes, employee benefits, and other related expenses. This category of expenses can significantly impact a company’s financial performance and is essential to track accurately in the chart of accounts.

Examples of employee-related expenses include:

- Salaries and wages: This includes the payments made to employees for their work.

- Payroll taxes: This includes taxes paid by the employer on behalf of employees, such as Social Security, Medicare, and unemployment taxes.

- Employee benefits: This includes various benefits offered to employees, such as health insurance, life insurance, retirement plans, and paid time off.

- Training and development: This includes expenses associated with training employees and developing their skills.

- Employee travel expenses: This includes expenses associated with employee business travel, such as airfare, hotel accommodations, and meal expenses.

By tracking these expenses in the chart of accounts, a company can gain insights into its total labor costs and identify areas for cost-saving opportunities. It can also help in budgeting, forecasting, and decision-making related to employee-related expenses.

Financial Expenses

Financial expenses in the (Accounting Tree) chart of accounting refer to the costs associated with borrowing and managing money. These expenses are typically incurred by businesses that need to raise funds for operations, investments, or expansions. Financial expenses can be a significant portion of a company’s overall expenses, and effective management of these expenses can have a significant impact on profitability.

Examples of financial expenses in the chart of accounting include:

- Interest expenses: Interest paid on loans, bonds, or other forms of debt.

- Bank charges: Fees charged by banks for various services such as account maintenance, wire transfers, and overdrafts.

- Foreign exchange losses: Losses incurred due to fluctuations in currency exchange rates when dealing with international transactions.

- Commissions and fees: Costs associated with obtaining financing or investment capital, such as underwriting fees or brokerage commissions.

- Debt issuance costs: Expenses incurred when issuing new debt, such as legal fees and registration fees.

Effective management of financial expenses involves optimizing debt structure, negotiating favorable terms with lenders, and implementing effective cash management strategies to reduce interest expenses and bank charges. It also involves accurately tracking and reporting financial expenses in the chart of accounting to ensure that they are properly reflected in financial statements and tax filings.

Rental Expenses

Rental expenses are a type of expense category in the chart of accounting that includes all expenses incurred for renting or leasing assets, such as buildings, equipment, and vehicles, used in business operations. These expenses are usually recurring and must be paid regularly to keep the assets in use. Rental expenses can be a significant expense for many businesses, particularly those in industries that rely heavily on leasing or renting equipment.

Examples of rental expenses include:

- Rent on business premises: This refers to the cost of leasing or renting a building or office space for business operations.

- Lease payments for equipment: This includes lease payments for machinery, computers, vehicles, or other equipment used in business operations.

- Rental fees for storage space: This includes rental fees for warehouses, storage units, or other spaces used for storing inventory, equipment, or supplies.

- Lease payments for office equipment: This includes lease payments for items like copiers, printers, and office furniture.

- Rent for land or property: This includes rental payments for land or property used for business operations, such as a parking lot or storage yard.

Rental expenses are important to track in the chart of accounting as they can significantly impact a company’s bottom line. Properly accounting for rental expenses can help businesses make informed decisions about whether to lease or buy equipment, negotiate better lease terms, and accurately forecast their expenses for budgeting purposes.

Supplies Expenses

Supplies expenses refer to the cost of purchasing and using various supplies required for the operation of a business. These expenses are necessary to keep the business running and provide the products or services that the business offers. The value of tracking supplies expenses is to identify areas where cost savings can be made, and to accurately calculate the cost of goods sold or services provided.

Examples of supplies expenses include office supplies such as paper, pens, and printer ink; maintenance supplies such as cleaning supplies, light bulbs, and tools; and production supplies such as raw materials, packaging materials, and fuel.

Tracking supplies expenses in the chart of accounts allows for the accurate recording of these expenses and their impact on the business’s bottom line. It also enables businesses to better manage their inventory levels and make informed decisions about when to reorder supplies. Additionally, it helps in identifying areas where cost-cutting measures can be implemented, such as finding more cost-effective suppliers or switching to more sustainable supplies.

Miscellaneous Expenses

The Miscellaneous Expenses category in the chart of accounting includes expenses that cannot be categorized under any other specific expense category. These expenses are usually unique and infrequent and do not fall into the other standard expense categories.

Add Value: Despite being an unspecific category, including a Miscellaneous Expenses account in the chart of accounts has some benefits. It helps to keep the other expense accounts more organized and meaningful. By grouping all other infrequent or unusual expenses under this category, it can help to simplify the accounting process and make it easier to understand the financial statements.

Examples of Miscellaneous Expenses:

- Losses due to natural disasters or theft

- Legal fees

- Donations and contributions

- Penalties and fines

- Non-recurring advertising expenses

- Research and development expenses

- Miscellaneous office expenses

- Professional fees and consulting services

- Miscellaneous taxes and licenses

- Travel expenses outside of normal business travel.

Gains and Losses

The Gains and Losses category in the chart of accounting refers to the financial transactions that result in gains or losses for a company during a specified period. These transactions are not related to the company’s normal business operations and are usually one-time events. This category includes gains or losses from the sale of long-term assets, investments, or the settlement of legal disputes.

The add value of having a Gains and Losses category in the chart of accounting is that it provides a way to track non-operating gains and losses separately from normal business operations. This allows management to assess the overall financial performance of the company beyond its day-to-day activities.

Examples of gains and losses that would fall under this category include gains or losses from the sale of property, plant, and equipment, write-offs of assets that are no longer in use, gains or losses from the sale of investments, and gains or losses from the settlement of legal disputes. These gains and losses are reported separately from the company’s core operating activities, such as revenue from sales and expenses related to the production and sale of goods and services.

It is important to note that while gains and losses in this category are not directly related to a company’s operations, they can still have a significant impact on the company’s financial statements and overall financial performance. Therefore, it is important for companies to carefully track and report gains and losses in this category to ensure accurate financial reporting and analysis.

Clearing Accounts

Clearing Accounts refer to temporary holding accounts in the chart of accounting that act as a clearinghouse for various transactions. The purpose of these accounts is to facilitate the reconciliation of different accounts and ensure the accuracy of financial statements.

Add Value: Clearing accounts can help businesses keep track of transactions between two parties. By using a clearing account, businesses can avoid errors that may occur when multiple transactions are posted simultaneously.

Examples:

- Bank Clearing Account: This account is used to reconcile discrepancies between the company’s bank statement and accounting records. Any differences between the two will be recorded in this account until they are resolved.

- Customer Clearing Account: This account is used to reconcile differences between the accounts receivable sub-ledger and the general ledger. It is used when a customer has paid an incorrect amount, and the company needs to allocate the payment to the correct invoice(s).

- Vendor Clearing Account: This account is used to reconcile differences between the accounts payable sub-ledger and the general ledger. It is used when a vendor has been paid an incorrect amount, and the company needs to allocate the payment to the correct invoice(s).

- Inventory Clearing Account: This account is used to track inventory that has been received but not yet assigned to a specific location or job. It is used when a company receives inventory but has not yet determined where it will be used or sold. Once the inventory is allocated, the amount is transferred from the clearing account to the appropriate inventory account.

In conclusion, Vodo’s chart of accounts consists of various accounts that are classified into different categories or headings for ease of recording and analysis. These categories include less: expenses, employee-related expenses, financial expenses, rental expenses, supplies expenses, miscellaneous expenses, standard cost variance, gains and losses, and clearing accounts. By using this chart of accounts , Vodo can easily record its financial transactions, analyze its financial performance, and make informed business decisions.